YEG REAL ESTATE RESULTS DECEMBER – FULL YEAR 2022 –JFSELLS.COM

Posted by John Fraser on

YEG REAL ESTATE RESULTS DECEMBER – FULL YEAR 2022 – JFSELLS.COM

Full 5 year stats package here DEC_2022_CREA-EDMOstats

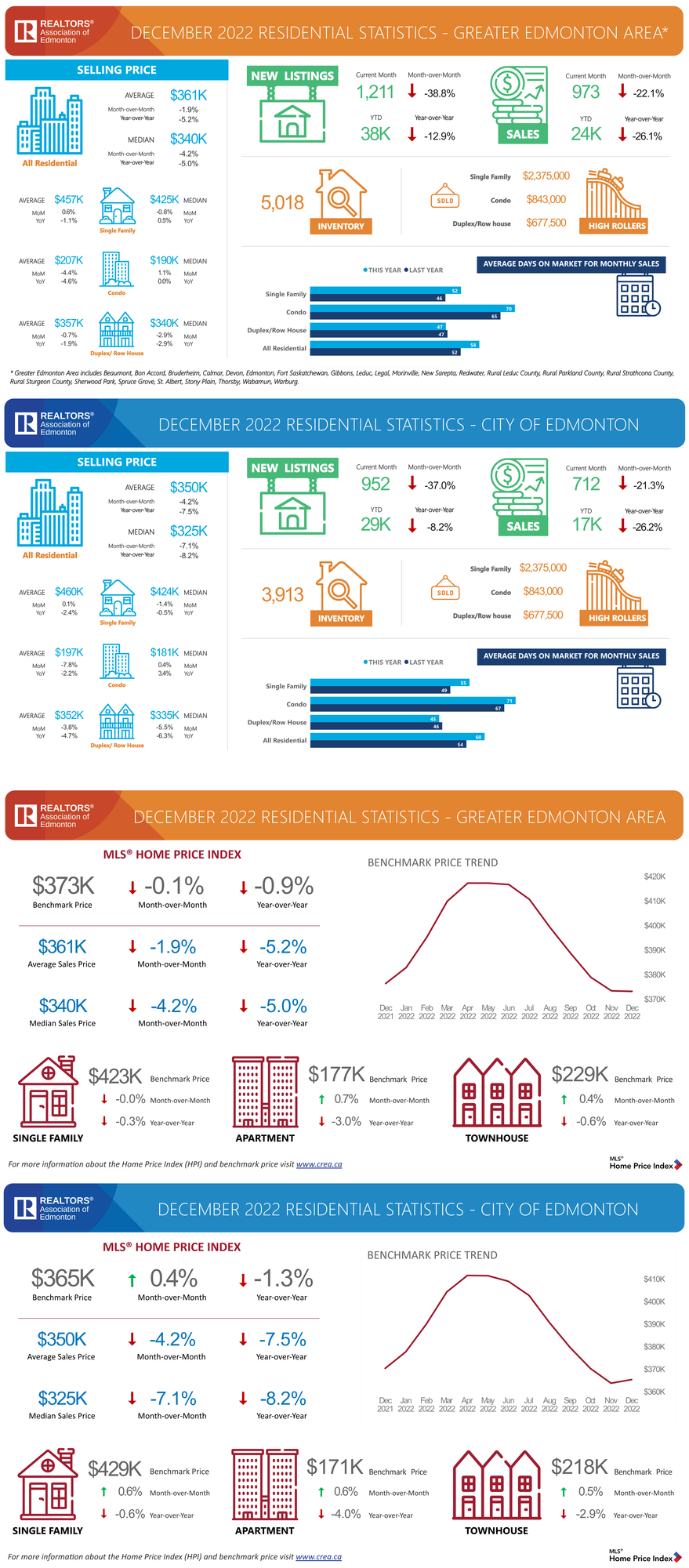

| MLS® HPI Benchmark Price* | Dec ‘22 | M/M % | Y/Y % |

| (for all-residential sales in GEA1) | |||

| SFD2 benchmark price | $423,300 | 0.0% | -0.3% |

| Apartment benchmark price | $176,500 | 0.7% | -3.0% |

| Townhouse benchmark price | $229,000 | 0.4% | -0.6% |

| Composite7 benchmark price | $373,200 | -0.1% | -0.9% |

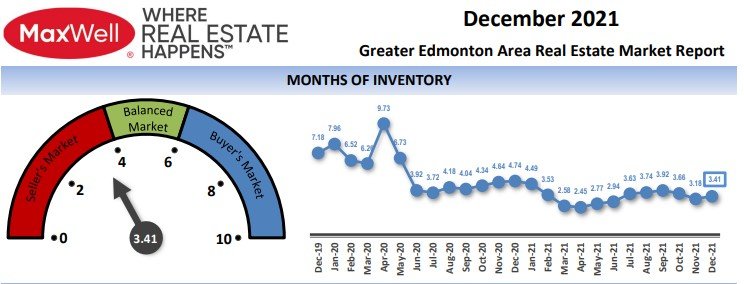

2022-12_Edmonton_Statistics 2 year summary:

…

70 Views, 0 Comments